Showing posts with label Banks. Show all posts

Showing posts with label Banks. Show all posts

Monday, October 14, 2019

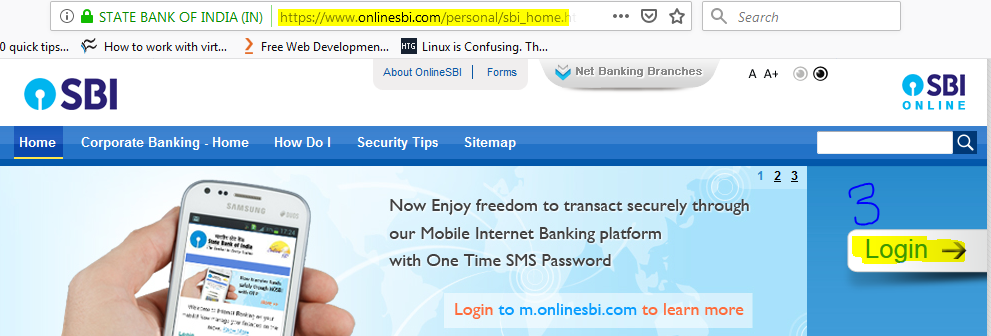

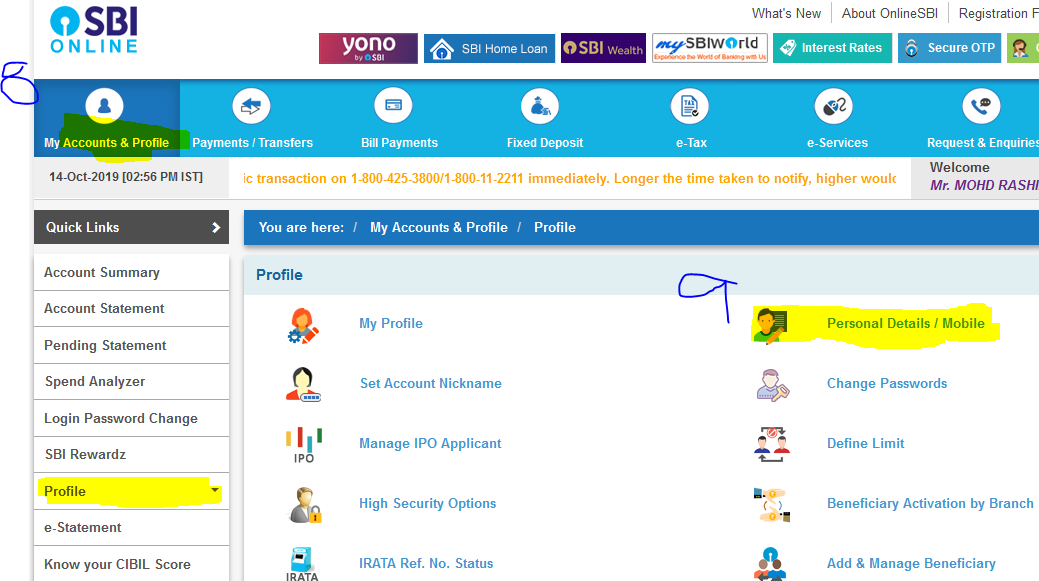

How to Update or Change Mobile Number in SBI Account Holders Through Online

Cloud Network

October 14, 2019

Tags:

Banks

Providing on the Web, online library and learning platform for IT Professional Developers with a unique blend of original content, peer-to-peer advice from the largest community of IT.

Providing on the Web, online library and learning platform for IT Professional Developers with a unique blend of original content, peer-to-peer advice from the largest community of IT.

Tuesday, October 1, 2019

SBI New Service Charges Started from 1st Oct-2019: ATM Withdrawal

Cloud Network

October 01, 2019

SBI New Service Charges Started from 1st Oct-2019: ATM Withdrawal - AMB - Cash Deposits Everything You Want to Know

Non-Maintenance of Average Monthly Balance (AMB) 1 A customer can withdraw up to ₹50,000 at non-home branches. 2 Charges for transactions beyond the free limit ( ₹per transaction) ₹50/- + GST 3 SBI offers its customers 3.50% interest rates on savings deposit balance of up to ₹1 lakh.

and Above ₹1 lakh, the interest rate levied on savings balance is 3%. 4 '3' free cash deposit transactions in a month, after that the bank will charge Rs 50+GST

Metro & Urban Center branches S No AMB Charged per Month 1 Rs. 3,000 shortfalls by 50 per cent then Rs 10 + GST 2 Below > Rs. 3,000 shortfalls by 50-70 per cent then Rs 12 + GST 3 Below >> Rs. 3,000 shortfalls by 70 per cent then Rs 15 + GST

SBI account holder needs to maintain an average monthly balance of ₹3,000 for metro

Semi-Urban Center branches S No AMB Charged per Month 1 Rs. 2,000 shortfalls by 50 per cent then Rs 7.5 + GST 2 Below > Rs. 2,000 shortfalls by 50-70 per cent then Rs 10 + GST 3 Below >> Rs. 2,000 shortfalls by 70 per cent then Rs 12 + GST

SBI account holder needs to maintain an average monthly balance of ₹1,000 for semi ubran

Rural Center branches S No AMB Charged per Month 1 Rs. 1,000 shortfalls by 50 per cent then Rs 5 + GST 2 Below > Rs. 2,000 shortfalls by 50-70 per cent then Rs 7.5 + GST

SBI account holder needs to maintain an average monthly balance of ₹1,000 for Rural

This Rule is Only for Saving Account S No Metro, Semi-Urban & Rural Areas Charged per Month 1 Upto Rs. 25,000 Rs 2 + GST 2 Above Rs. 25,000 to Rs. 50,000 Rs 10 + GST 3 Above Rs. 50,000 to Rs. 1 Lakhs Rs 15 + GST 4 Above Rs. 1 Lakhs Unlimited Free Cash Withdrew at Any Bank/ATM

NEFT Transaction at Branches S No Metro, Semi-Urban & Rural Areas Charged per Month 1 Upto Rs. 10,000 Rs 2 + GST 2 Above Rs. 10,000 to Rs. 1 Lakh Rs 4 + GST 3 Above Rs. 1 Lakh to 2 Lakh Rs 12 + GST 4 Above Rs. 2 Lakh Rs 20 + GST

RTGS Transaction at Branches S No Metro, Semi-Urban & Rural Areas Charged per Month 1 Above Rs. 2 Lakh to 5 Lakh Rs 20 + GST 2 Above Rs. 5 Lakh Rs 40 + GST

Cash Withdrawals S No Metro, Semi-Urban & Rural Areas Monthly 1 Below Rs. 25,000 2 Free Cash Withdrew at Any Bank/ATM 2 Rs. 25,000 to Rs. 50,000 10 Free Cash Withdrew at Any Bank/ATM 3 Rs. 50,000 to Rs. 1 Lakhs 15 Free Cash Withdrew at Any Bank/ATM 4 Above Rs. 1 Lakhs Unlimited Free Cash Withdrew at Any Bank/ATM

For More Details Check Out Here : https://www.onlinesbi.com/

Providing on the Web, online library and learning platform for IT Professional Developers with a unique blend of original content, peer-to-peer advice from the largest community of IT.

Providing on the Web, online library and learning platform for IT Professional Developers with a unique blend of original content, peer-to-peer advice from the largest community of IT.

Wednesday, September 25, 2019

SBI Saving Bank Account AMB and Free Cash Transition

Cloud Network

September 25, 2019

| This Rule is Only for Saving Account | ||

| S No | Metro, Semi-Urban & Rural Areas | Monthly |

| 1 | Below Rs. 25,000 | 2 Free Cash Withdrew at Any Bank/ATM |

| 2 | Rs. 25,000 to Rs. 50,000 | 10 Free Cash Withdrew at Any Bank/ATM |

| 3 | Rs. 50,000 to Rs. 1 Lakhs | 15 Free Cash Withdrew at Any Bank/ATM |

| 4 | Above Rs. 1 Lakhs | Unlimited Free Cash Withdrew at Any Bank/ATM |

| 1 | A customer can withdraw up to ₹50,000 at non-home branches. | |

| 2 | Charges for transactions beyond the free limit ( ₹per transaction) ₹50/- + GST | |

| 3 | SBI offers its customers 3.50% interest rates on savings deposit balance of up to ₹1 lakh. | |

| And Above ₹1 lakh, the interest rate levied on savings balance is 3%. | ||

| For More Details Check Out Here : https://www.onlinesbi.com/ | ||

Providing on the Web, online library and learning platform for IT Professional Developers with a unique blend of original content, peer-to-peer advice from the largest community of IT.

Providing on the Web, online library and learning platform for IT Professional Developers with a unique blend of original content, peer-to-peer advice from the largest community of IT.